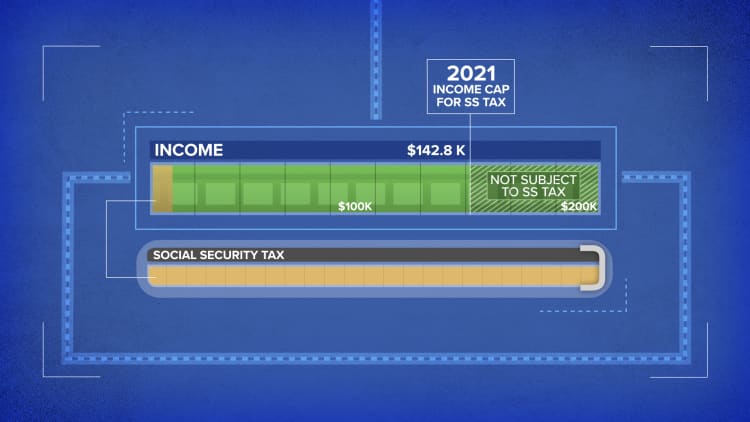

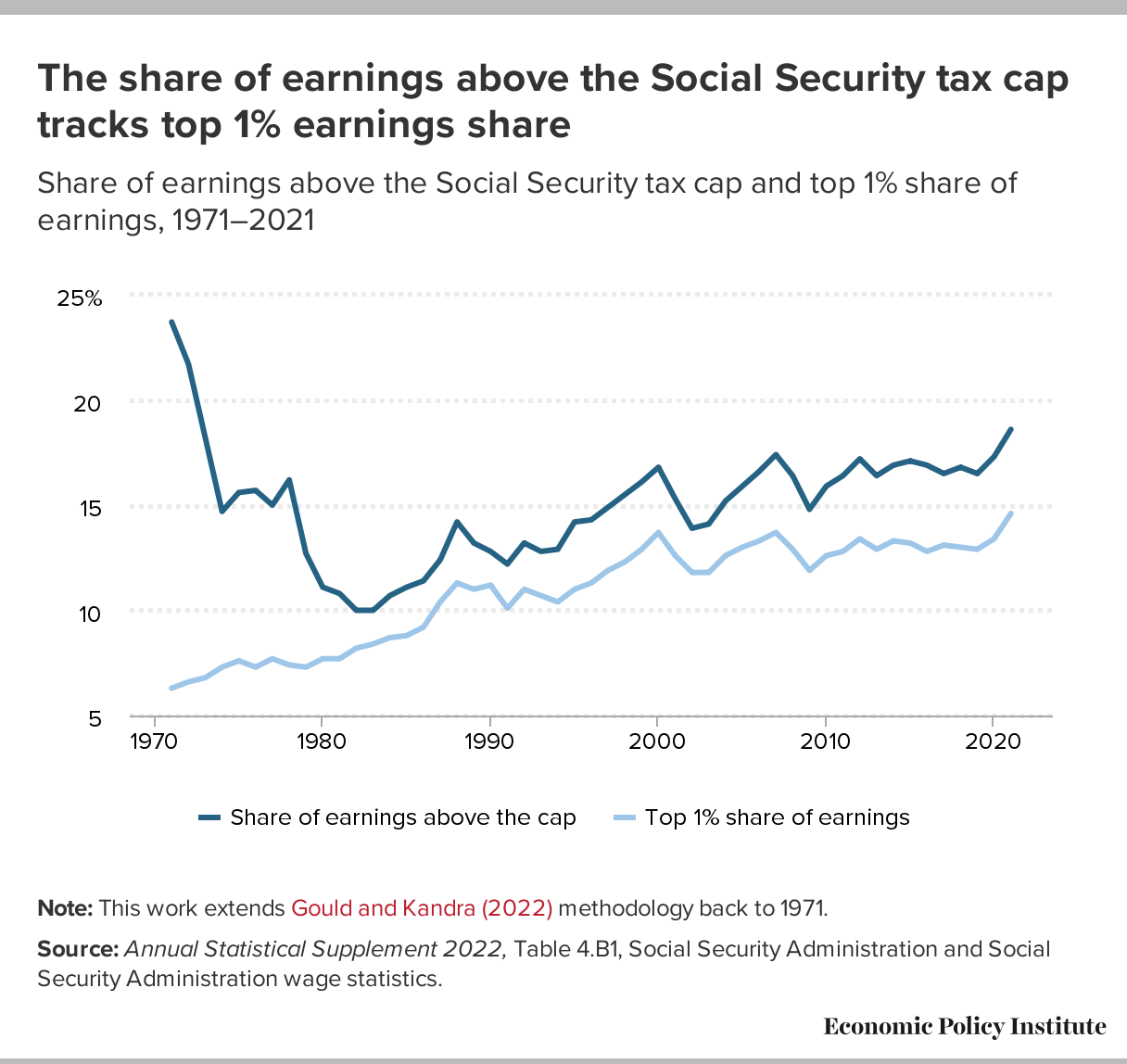

A record share of earnings was not subject to Social Security taxes in 2021: Inequality's undermining of Social Security has accelerated | Economic Policy Institute

Repealing the Federal Tax Law's Cap on State and Local Tax (SALT) Deductions Is No Improvement – ITEP

Who Would Pay More if the Social Security Payroll Tax Cap Were Raised or Scrapped? - Center for Economic and Policy Research

Cap-and-Trade versus Carbon Tax: Carbon Pricing Issues and Selected Country Implementations (Climate) eBook : Akinci, Ugur: Amazon.co.uk: Books

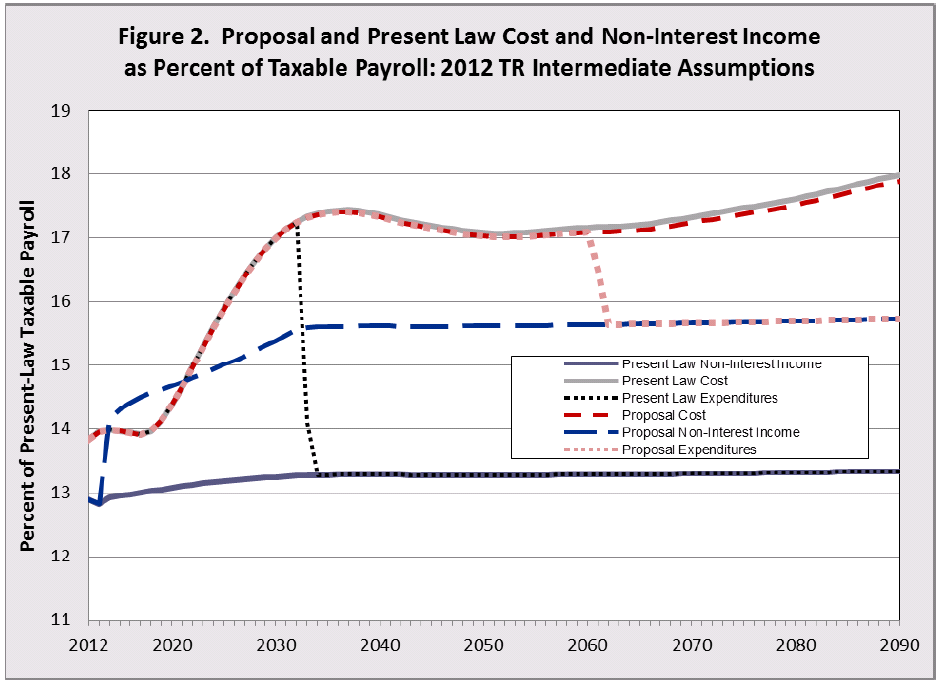

Could Eliminating the Payroll Tax Cap Extend Solvency to 2061 and Allow for Expanded Benefits? | Committee for a Responsible Federal Budget

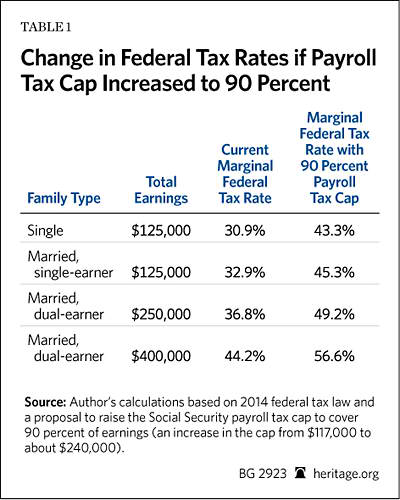

Raising the Social Security Payroll Tax Cap: Solving Nothing, Harming Much | The Heritage Foundation

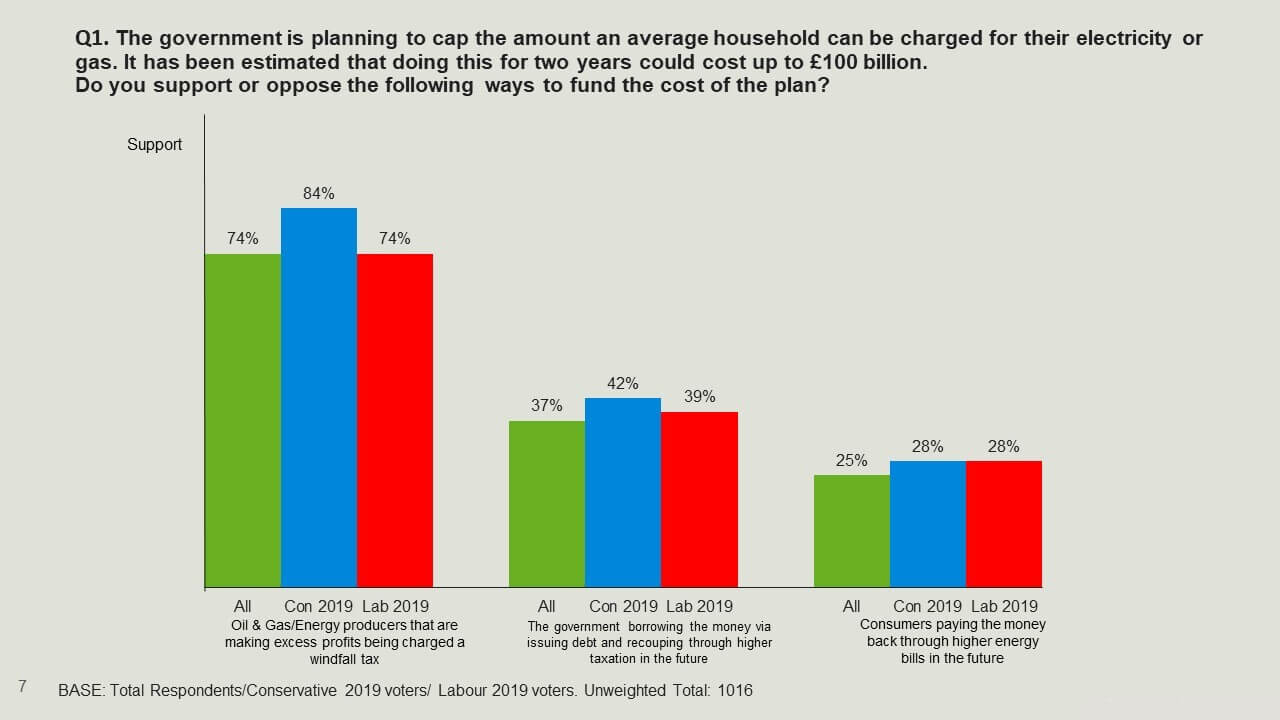

Survation | Public and Conservative voters believe windfall tax on energy producers should form a part of paying for energy bill cap | Survation

Scrapping the Social Security Payroll Tax Cap: Who Would Pay More? - Center for Economic and Policy Research